- Bitcoin whales have accumulated large amounts of Bitcoin over the past few days.

- Owner profitability grew, and miner revenues declined.

Bitcoin [BTC] There has been a huge surge in whale accumulation over the past few days. Although the price is very close to its all-time high, many whales have not lost their conviction in the King coin.

Bitcoin: The big players are investing

The increasing appetite of whales indicates that there is high expectations for BTC to surpass current price levels.

Source: X

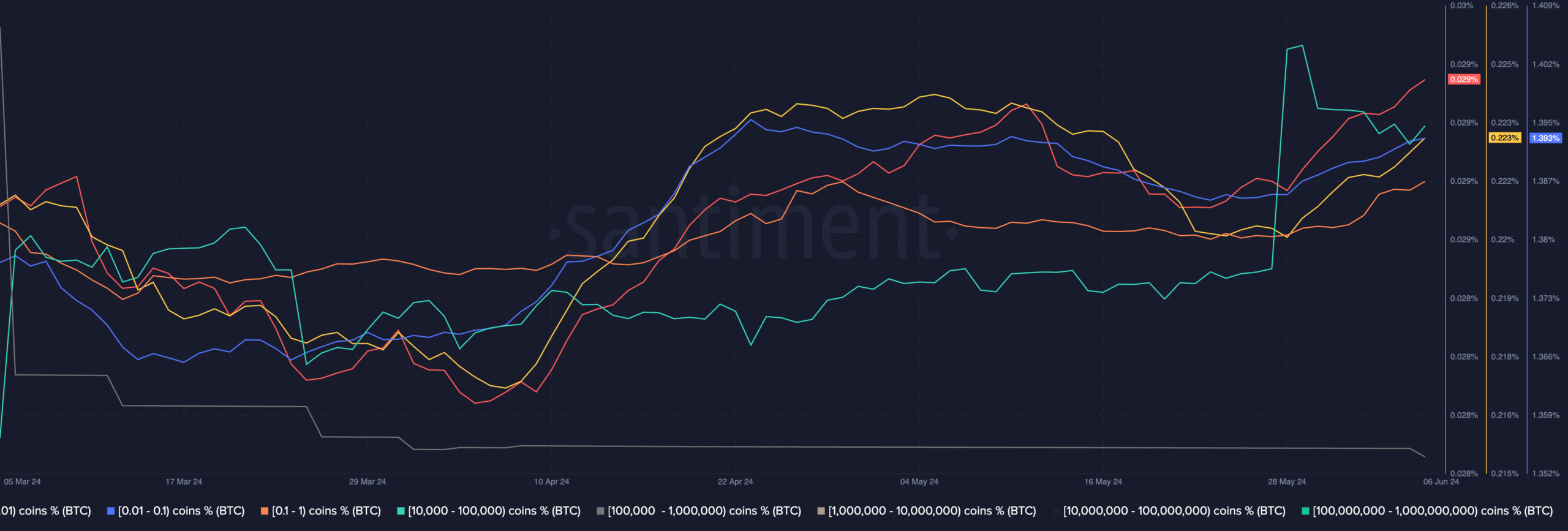

The story remained the same for individual investors as well. Over the past few days, retail investor interest in BTC has increased dramatically.

Addresses holding between 0.01 to 1 BTC have grown significantly. A push from whale investors and retail investors could help BTC surpass previously announced levels.

Source: Santiment

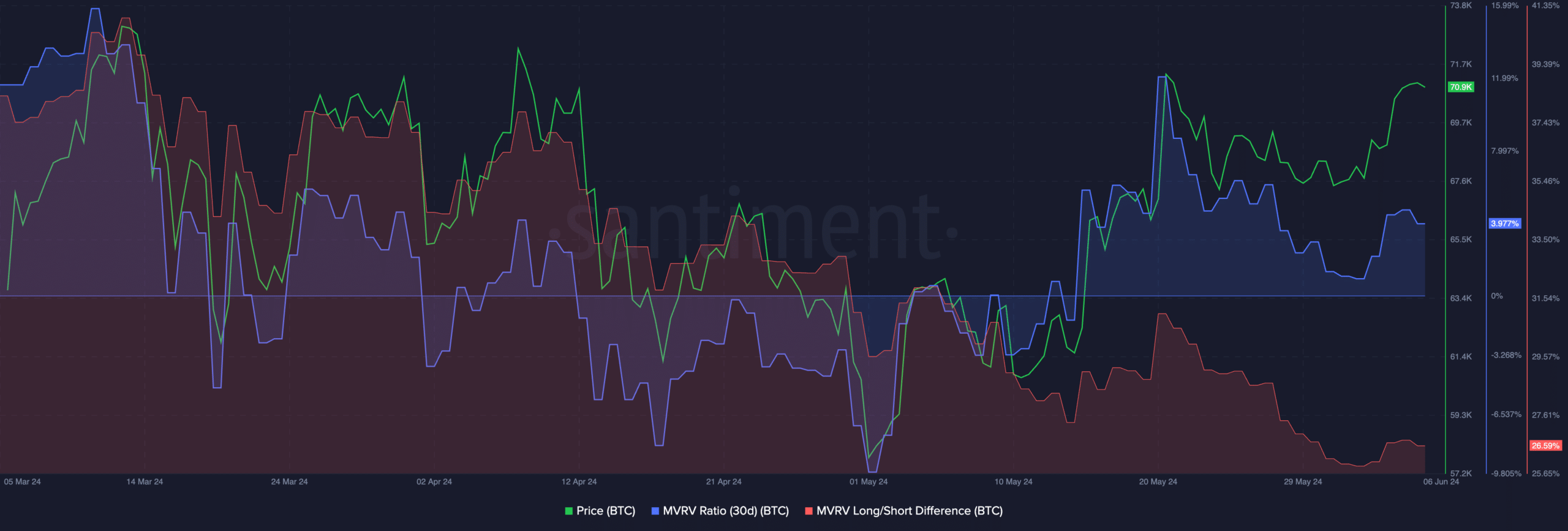

However, as the price of Bitcoin rises, the MVRV ratio also rises. AMBCrypto’s analysis of Santiment data revealed that the MVRV ratio for BTC holders has grown significantly.

This suggests that most shareholders were profitable at the time of writing. As a result, the incentive for these holders to sell is also growing, which could increase selling pressure on Bitcoin.

Besides, the long/short spread of Bitcoin has decreased.

This means that the number of new addresses holding Bitcoin has increased, and the percentage of long-term Bitcoin holders who have held Bitcoin for long periods of time has decreased.

Short-term bondholders are more likely to sell their holdings amid price volatility and uncertainty.

Source: Santiment

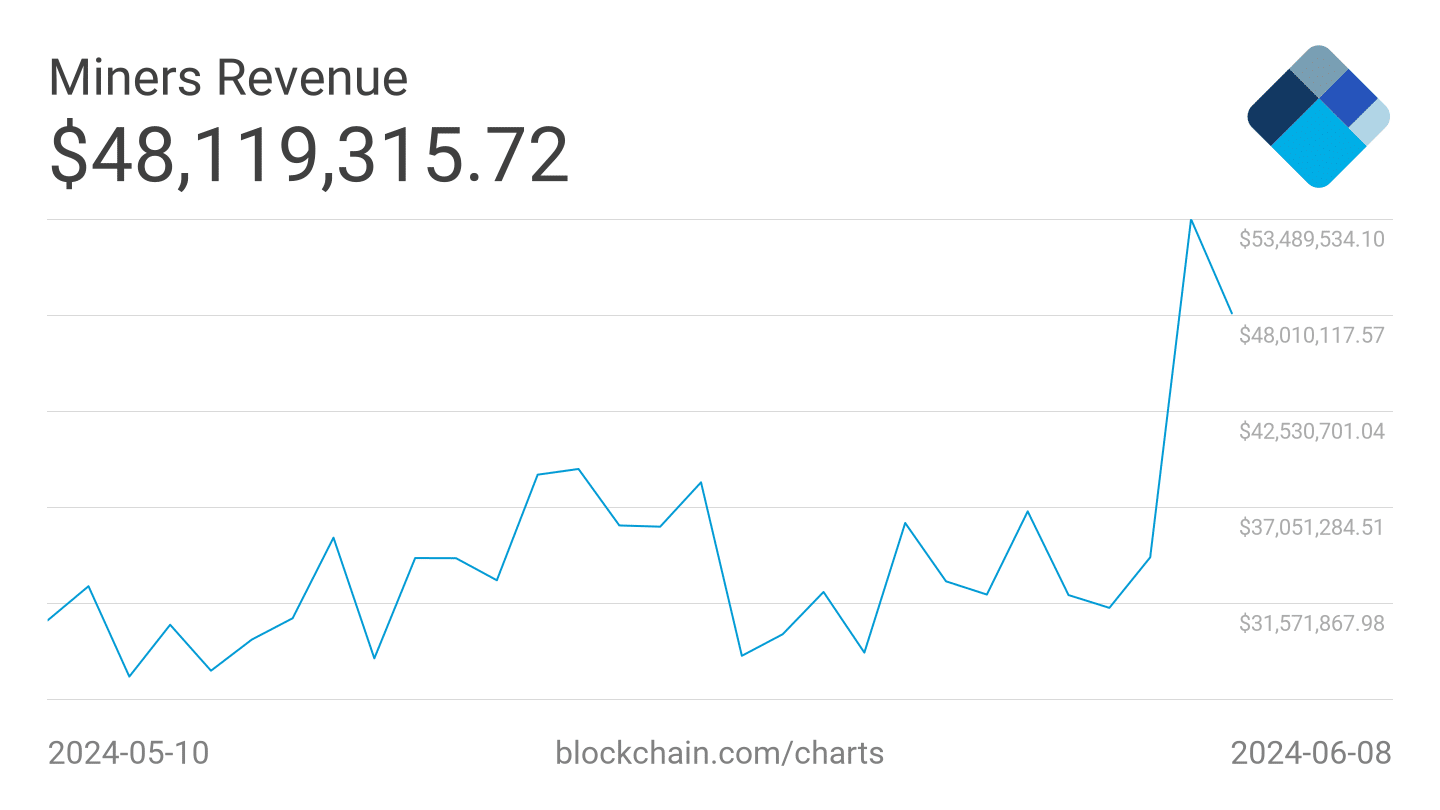

Decreased mining revenues

Another factor that can affect the state of BTC is how miners operate. Over the past few days, the revenue collected by miners has decreased from $53.48 million to $48 million.

If this trend continues, miners will have to sell their holdings to remain profitable. This could increase selling pressure on BTC and push prices lower further.

Source: Blockchain.com

Read Bitcoin [BTC] Price forecasts 2024-25

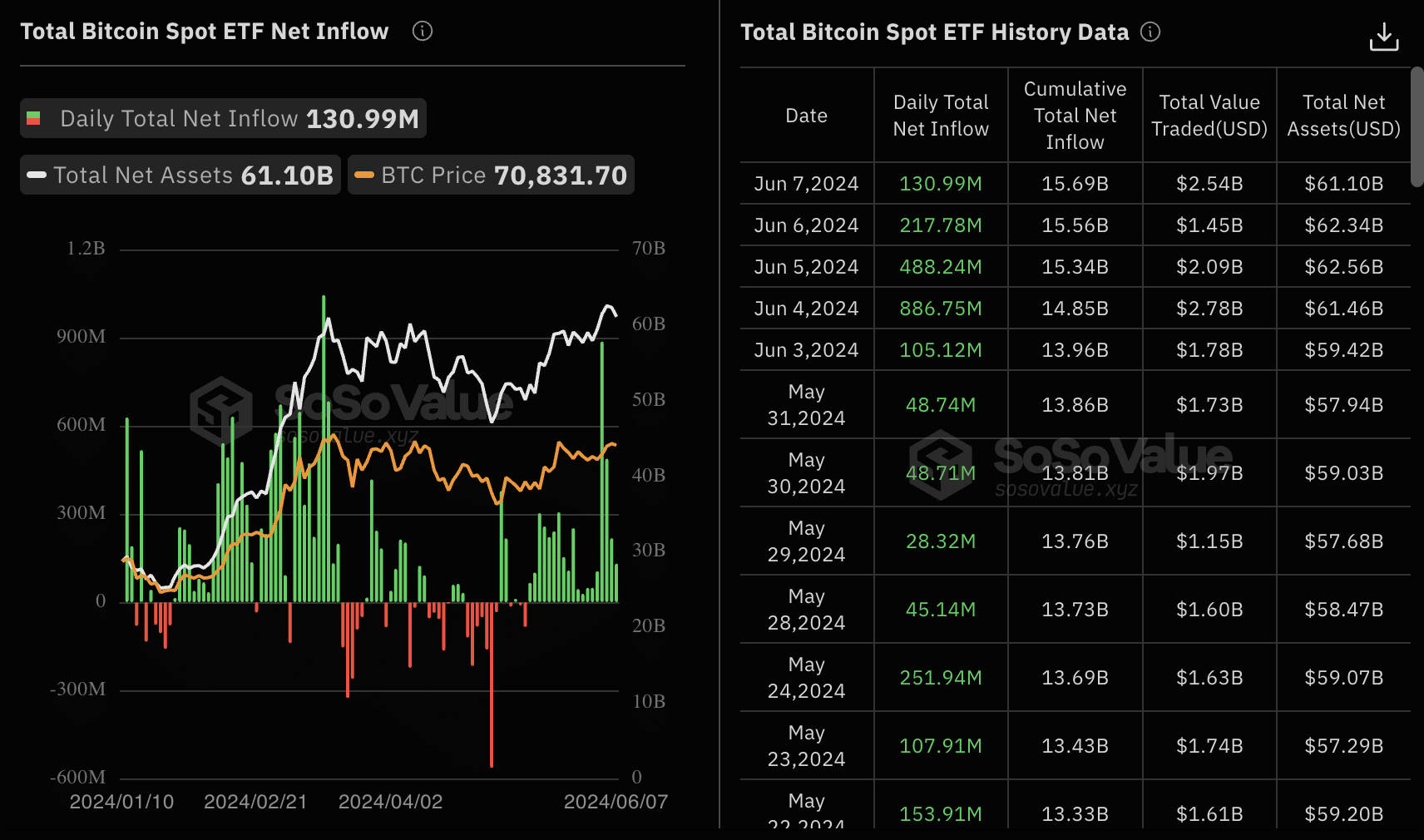

What could help ease the selling pressure around BTC is interest in BTC ETFs. Since May 31, inflows from ETFs have been very positive.

If interest in BTC continues to rise at this rate and more institutional investors continue to buy BTC, there could be more upward price movement in the future.

Source: SosoValue

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”